Freight rates for all modes of transport have been unstable and mainly increasing. Read more on the market outlook as well as the reasons for rate growth in the consolidated information prepared by experts.

ROAD TRANSPORT

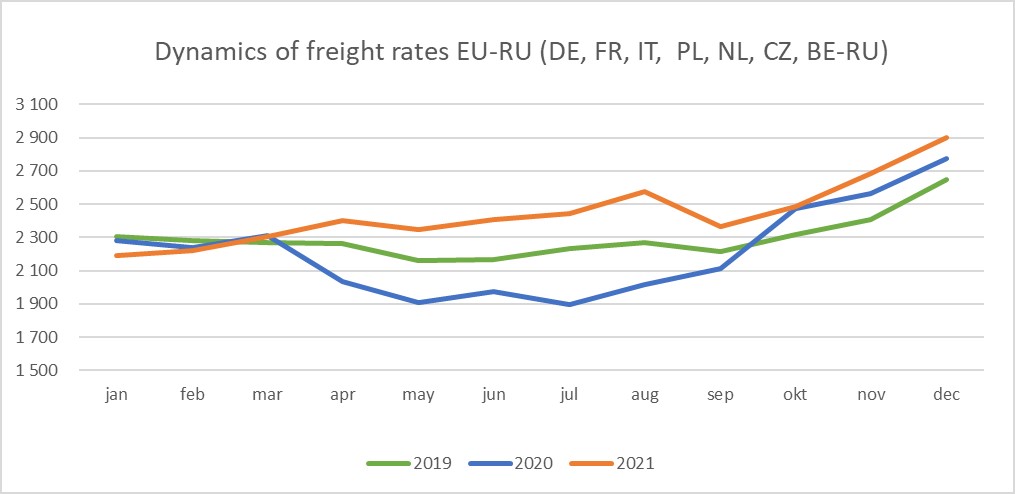

Road freight rates have been growing for a long time now and, as the expert conclude, will be further increasing.

Average freight rates in the main directions of imports from Europe to Russia in 2021 (according to data prepared by TELS Marketing Department)

Factors influencing the increase of rates

Factor 1. Growth in demand

The market of road transport from/to European Union saw a 9.7% increase in imports to Russia in January–October 2021 and a 16.5% increase in exports against the same period in 2020.

Demand for international road transport is increasing along with the recovery of the global economy.

Factor 2. Lack of transportation capacity

Excess demand always causes the rates to grow. There are several reasons for the growing shortage of transportation capacities today:

- Increasing demand for transportation (up to 50% in certain directions).

- Long-term, constant shortage of drivers. According to IRU, Europe experienced a shortage of over 400,000 drivers in 2021. There is a constant migration of skilled drivers to Western countries. As the demand for transport services recovers, the shortage of drivers will increase up to 24% in Russia and 17% in Europe in 2022.

- Congestions at borders reduce the available volume of transport. Several thousand trucks queue regularly at the EU borders for several days.

Factor 3. Growth of expenses for carriers

The expenses for road carriers have been growing faster than the transportation rates for a long time. The costs grew so much over the past year that the market is no longer able to resist the rate growth. Carriers’ expenses are increasing for a variety of reasons:

- Increase in fuel price. Fuel prices have been constantly growing in Europe since May 2020 against the global increase in oil crude prices reaching all-time highs since October 2021. In Russia, the prices have been restrained by damping mechanisms during inflation. However, the inflation target in the Russian Federation is at the level of 4%, and it was more than 8% in 2021. So, the fuel prices in Russia have also increased significantly.

- Increase in car price. According to Russian Automotive Market Research agency, truck prices have increased by 72.2% in Russia over the past five years. The same trend is observed in many markets worldwide. The prices for the purchased automobiles have increased not only because of their higher nominal cost, but also due to an increase in leasing and loan rates.

- Increase in driver’s salary. The shortage of drivers results in the fact that the owners of transport businesses have to increase drivers’ salaries all the time in order to retain valuable staff. According to the owners of transport companies, drivers have seen an annual increase in pay of at least 10% over the past few years.

- Increase in transportation costs. More complicated and longer border-crossing procedures imply higher expenses. Since December 2021, cars may stand idly at the border between Belarus and the EU for several days, which is, according to rough estimates, around $ 150 per day. Due to step-by-step introduction of the Mobility Package in the European Union, carriers’ expenses are increasing as they have to ensure the required rest conditions of drivers in the EU countries, the return of trucks to the base, etc.

In addition to all that, the expenses are increased by road tolls, inflation, currency crashes, sanctions, import/export imbalance (an increase in empty miles), etc.

The opinions on the possible increase in road freight rates in 2022 range from 20 to 50%. Taking into consideration the current trends and the little chance that the situation in the transportation market gets better by using other modes of transport, a 50% increase in road freight rates is quite possible.

SEA TRANSPORT

One of the major problems in the shipping industry is congestion at ports. According to data from Seaexplorer (the indicator allowing to track ships anchored at world’s largest container ports), around 600 container ships are on berth or anchored at key ports, which is approx. 10% of the global container fleet.

So, despite the growth in the capacity of the global container liner fleet by 4.5% in 2021 (to 24.97 million TEU), the tensions in the industry preserves due to much longer waiting time at ports. And the beginning of 2022 is not encouraging either. “It is evident that the congestions and delays at ports are only getting worse,” warns Sea-Intelligence.

According to the Ocean Timelessness indicator, container delivery times have roughly doubled during the pandemic. For routes from Asia to Europe, the pre-pandemic average container delivery time was in the range of 55 to 60 days, and on January 2, the index reached a new record of 108 days.

Experts from Gazprombank Economic Forecasting Center report stable average cost index for sea transport since the beginning of 2022, which is lower than peak figures in September 2021 by 10% – around $9.4 thousand per FEU (40-foot container). Further reduction in price may take place after the Chinese New Year (February 1–6) or after the new vessels are put into operation when talking about the midterm period.

According to preliminary estimates of experts from Gazprombank, the volume of global maritime trade in containers increased by 7–9% in 2021, and it is still growing. This explains why there won’t be a significant reduction in freight rates soon.

As containership charter rates got to new record highs in January with demand for tonnage described as frantic, the rates will stay strong, Alphaliner reports. The rates are increasing across the whole fleet, especially for smaller ships – 3500 TEU in size. Such ships are now obtaining $ 60K per day for 36 months over $ 45K only a few weeks ago.

RAILWAY TRANSPORT

In the market of rail container transport, demand is growing at a rapid pace being limited by infrastructure constraints. Railway stations often cannot cope with the flow of container trains, so containers may stand idle for several days waiting for unloading.

“Additional tension to the situation is created by the existing problems with maritime transport as freight rates and the demand for transportation have increased several times,” the press service of Russian Railways Logistics explains. – “Global supply chains are being restructured. This is a long and painful process, so one should not expect a one-time solution of the situation.” According to Russian Railways Logistics, the situation will not get back to normal until the beginning of 2023.

The volume of containers transported within the Russian railway network in 2021 increased by 12.1% over 2020 totaling 6.5 million TEU. The volume of transit containers increased by 34.4% exceeding 1 million TEU.

The number of container trains between China and Europe increased by 22% in 2021 over 2020 totaling 15 thousand, Xinhua news agency reports. The volume of transit containers from China to Europe via Kaliningrad increased 2.6 times.

Global Times (Huanqiu shibao), the Chinese newspaper, published the results of survey of rail freight users on the possible abolition of government export subsidies for transportation. It’s most likely that the subsidies will be fully abolished in 2022.

To recap, the Chinese government has been paying subsidies for railway transportation since 2012 to promote the export of Chinese products. The subsidies allowed to reduce rail freight rates significantly – from an average of $9,000 to $5,000/FEU with further stable rates at $5,500/FEU.

In the past two two years, the Chinese government has been cutting the subsidies against the growth in demand. Currently, the Chinese rail subsidies stand at $1,000 per container.

There is no doubt that the rates for rail freight transport from China to Russia and Europe will increase. This will happen not only because of the expected abolishment of Chinese subsidies, but also because the Russian Railways are boosting the rates for rail freight by 12% in accordance with the new transport strategy adopted by the Russian Federation.

AIR TRANSPORT

The global volume of air cargo increased by 6.9% at the end of 2021 over pre-pandemic 2019, the International Air Transport Association (IATA) reports. At the same time, the carrying capacity reduced significantly due to a multiple decrease in the number of passenger flights used to transport cargo in baggage compartments.

According to the Baltic Exchange Airfreight Index and TAC Freight, reflecting the change in air freight rates, the prices from Shanghai to North America reached $14 per kilo for the first time in December 2021 – and the price has almost doubled in just three months. Similar increase was recorded from Hong Kong to Europe and the USA, as well as on transatlantic routes between Frankfurt and North America.

Air transport from China will be experiencing capacity shortage for a long time, including due to the ban of the Civil Aviation Administration of China to transport cargo (with the exception of medical items) in aircraft passenger cabins. Passenger flights will not be restored in the near future due to the spread of the new coronavirus variant. Thus, the air freight rates from China, which have gone record high in 2022, are unlikely to go down.

The Aviation Safety Agency of the European Union (EASA) and the US Federal Aviation Administration (FAA) are extending the rules allowing the airlines to carry certain cargo in passenger holds until July 2022.

Sources: TELS Marketing Department, TASS, ati.su, rzd-partner.ru, infranews.ru, seanews.ru