Dear colleagues and partners,

We would like to share statistics figures and estimates on the rate growth from European road freight carriers. This information is important for understanding the near and long-term prospects in the freight market both within the European Union and to / from Europe.

Fuel price rise results in the growth of rates from Polish carriers

High fuel prices in Poland are explained by relatively expensive crude oil and the weak zloty exchange rate, which has preserved since March 2020.

At the same time, Brent crude on all exchanges have already exceeded $86 per barrel (October 2021), the first time in the past 3 years. The inflation rate in Poland in October 2021 amounted to 5.5% - the highest figure over the past 20 years.

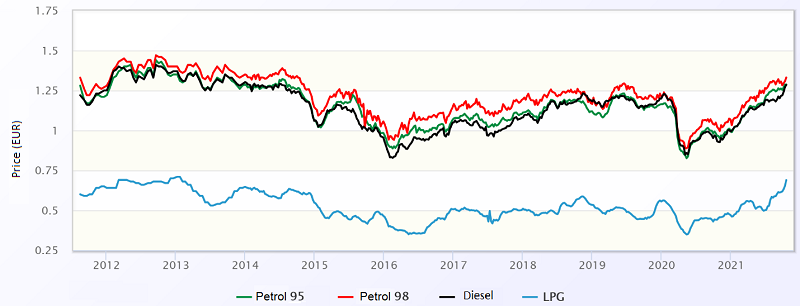

Dynamics pattern in the retail fuel price in Poland, EUR / liter

There has been a steady trend upward in the fuel price since May 2020. In October 2021, the price was almost record-high, as in 2012. Thus, fuel prices in Poland are not only close to their absolute formal records, but also much higher than a year ago.

It’s quite interesting that the situation with the fuel price rise is typical not only for Poland – it’s is a general trend in the EU countries and Russia. This is primarily explained by the rise in crude oil prices and certain economic factors.

For transport companies, any changes in the fuel purchase price result in the immediate increase in costs for the entire logistics chain. On average, fuel costs make 20% of the rates for transport companies, so the increase in price for this component can significantly affect the final freight rates.

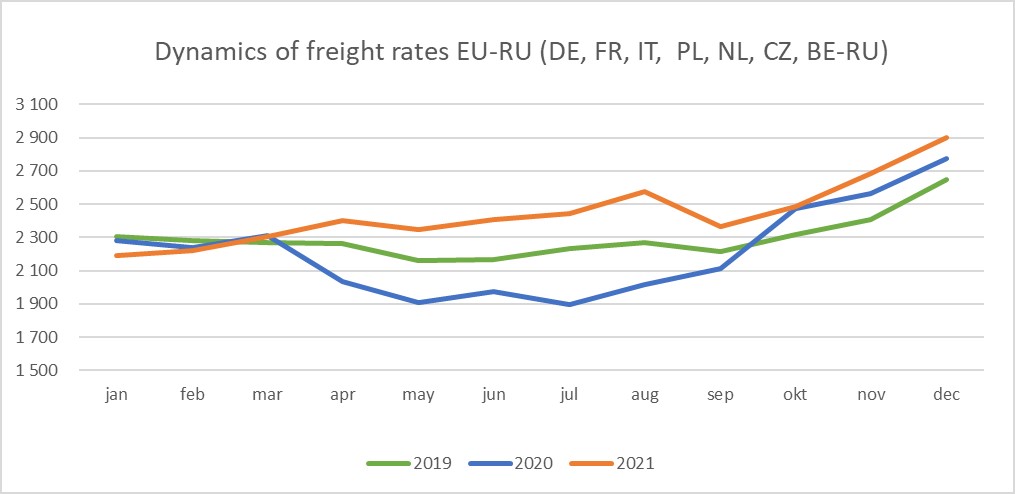

This is confirmed by the figures on the growth rates for export from Europe to Russia in 2021.

The trend is estimated to preserve until the end of 2021 and continue in 2022. The estimated growth rates in 2022 is at the level of +3.6 p.p.

Mobility Package will increase the rates in 2022

The Mobility Package adopted by the European Union is changing the way international road transport will work. The regulations concern:

- Obligatory rest for drivers.

- Return of drivers to the base.

- Extending the driving time of the vehicle.

- Cabotage.

- Rules for the design of the delegation of drivers.

- Licenses and tachographs for carriers with a fleet of 2.5 to 3.5 tons in international transport.

- Replacement of tachographs.

Part of the requirements of the Mobility Package (on the working and rest hours, the obligation to return to the country of registration, etc.) entered into force on August 20, 2020. And soon the carriers will need to adapt to more changes in the road legislation.

According to the European Commission, the changes in international transport legislation are aimed to maintain the balance between driver’s safety, social justice and a balanced economy focusing on market and economic needs of the EU. The main goal of the Mobility Package is to improve drivers’ working conditions in all EU countries.

However, as the Polish transport associations say about the Mobility Package, these changes may become a “coffin nail” for Polish companies carrying out international transportations as they will be forced to move to Western Europe. In other words, they will have to transfer their companies and pay taxes on the territory of Western European countries.

For example, 51% of domestic goods in France are transported by Polish carriers (cabotage) as the transportation capacity there is not enough. The same situation is in Germany.

According to the figures of large Polish transport companies, the next stages of the Mobility Package may result in the increase of intra-European transportation costs by an average of 30%.

It is still very difficult to determine how much the rates will increase after the implementation of the third stage of the Mobility Package. But this will begin in the second quarter of 2022 for sure.

***

TELS Group experts are constantly monitoring the changes in the logistics market and possibilities to optimize supply chains trying to preserve in the current circumstances the existing agreements with customers and partners as much as possible. It is always necessary to consider the significant changes in the conditions of work with road carriers to maintain stable relationships with them and provide customers with the required volume of carrying capacity.

TELS Marketing Department