In an effort to mitigate the risks of losing Western markets, China will intensify its tough policy of export expansion to the markets of Russia and countries of the Global South, which is an unfavorable factor for the prospects of producers and exporters in other countries, experts of the Analytical Department of TELS GLOBAL warn in their report.

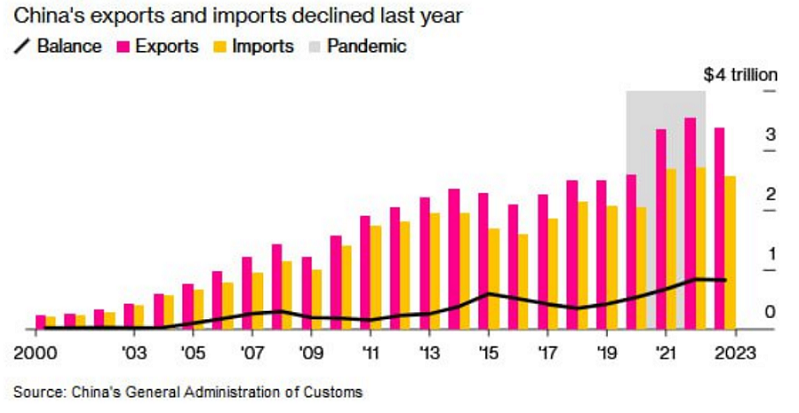

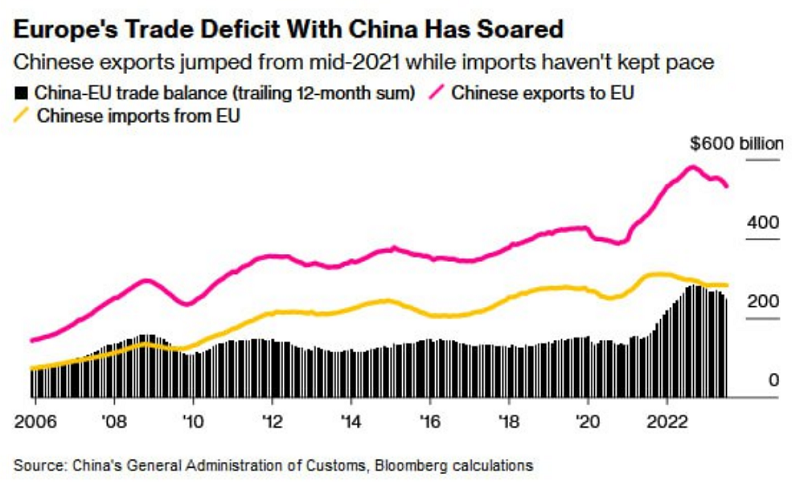

China’s trade with the US and EU is shrinking: for the first 11 months of 2023, in monetary terms, the declines are 12% and 7.6% respectively (according to the General Administration of Customs of China). This is the consequence not only of the growing political tension between China and the US, but also of the complication (increase in cost) of logistics between China and the EU: at first, the refusal of some European importers to transit cargo through Russia, then the lengthening of sea routes due to the crisis in the Red Sea, etc. For example, Germany’s trade volume with the US is already larger than with China. In addition, the EU has begun to take conscious measures to reduce the Chinese imports that threaten some of its industries.

One of the main pillars and growth drivers of the Chinese economy are the real estate market and manufacturing exports. The real estate market is currently facing a crisis, which the Chinese authorities are trying to curb by means of state support. The exports are dropping, and the rapid growth of trade with Russia (+46.9% of exports to Russia in monetary terms in 2023) and some other countries does not compensate for the losses from the decline in trade with the US and the EU.

The development of global political trends shows that the risk of a military conflict in the Asia-Pacific region is not only unlikely to decrease, but is steadily growing. If this conflict occurs, it is most likely to permanently undermine China’s economic relations with its so far major trading partners, the US and the EU.

The output of the Chinese industry is so large that the domestic market can currently consume just over half of what it produces, as estimated by Bloomberg. Correspondingly, the other half has to be exported elsewhere.

To secure future sales in case all risks materialize, China works in two directions: it tries to quickly develop the domestic market and increase its exports to the markets of “friendly” countries by all possible means.

China will pursue political and economic expansion not just actively, but even aggressively in the markets of the Global South – India, Brazil, Central Asia, the Middle East, and Africa – to increase its control over these markets in order to boost sales of its products. If it succeeds, Chinese goods will create strong competition to goods from around the world, which will consequently weaken the prospects for exporters of similar products from other countries. Even in the domestic market of other countries, Chinese products will be a pain in the neck for local producers (although for consumers this would be rather positive news).

At the same time, China, with its developed infrastructure and fairly stable economy, confidently retains its status as an influential player on the global stage. Its extensive network of transport highways, high-tech ports, and logistics centers make it a key player in global freight transportation. Strategic investments in the development of the global transportation infrastructure assert its leadership in logistics and the global economic system.

In 2023, China’s economy expanded by 5.2%, which is low by the country’s standards. The performance of the Chinese trade in January through February significantly exceeded expectations: the exports year-on-year increased by 7.1% up to 528 billion dollars, and the imports by 3.5% up to 402.85 billion dollars. This is partly a consequence of the low base of the beginning of 2023, however, even taking this into account, analysts were expecting an average growth of exports by 1.9%, and imports by 1.5%.